Real Estate Terminology

Buyer’s Market vs. Seller’s Market

The real estate market is constantly changing. The way we determine the type of real estate market we’re in (Buyer’s Market vs. Seller’s Market) is based on the amount of Inventory (homes available for sale) currently available. Six months of inventory is usually considered “equilibrium” —neither a Seller’s or Buyer’s Market. A Buyer’s Market is considered to be 7 months or more of inventory. This is where the demand for homes is somewhat less than the supply of homes and when Buyers may have more control over house prices than Sellers. A Seller’s Market is considered to be 5 months or less of inventory. This is where the demand for homes is somewhat greater than the supply of homes and when Sellers may have more control over house prices than Buyers.

Months of Inventory

Months of Inventory refers to the number of months it would take to sell all of the currently listed homes on the market, with no new homes being added. This may also be called the “Absorption Rate” because it is the rate in which houses are “absorbed” in the current market. Generally speaking, if Inventory is greater than 6 months, then it is a “Buyers Market,” and if Inventory is less than 6 months, then it is a “Sellers Market.”

|

Cumulative Days On Market

How long it takes to sell homes can be a good indicator for “how’s the market”? The longer it takes to sell homes, on average, the slower the market. So if the cumulative number of Days on Market is increasing, then the market may be slowing down, and if CDOM is decreasing, then the market may be speeding up.

“Days on Market” refers to the days a specific home listing has been on the MLS. If the real estate agent Terminates the listing and then relists it with a new MLS number, then the DOM resets. However, the Cumulative Days On Market should show the total Days on Market for that particular home, regardless of the number of time it is terminated and relisted by one or more real estate agents.

Keep in mind that areas with lower-priced homes will usually sell faster than luxury-priced areas, because the more affordable the home’s price, the larger the number of potential buyers, and the quicker it can sell.

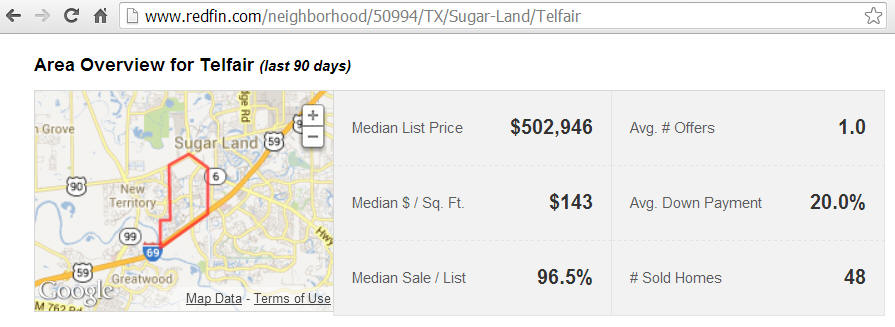

Median Price

Median Price is not the same as the Average Price; it is the middle point for real estate prices. The Median Price is the price in the middle of all the sales prices for a certain time-period, with exactly half of the houses priced for less and half priced for more.

It is generally believed that the Median Price is the best indicator for market activity because it is less affected by abnormally low prices or high prices (which skew the Average Price).

Overall Real Estate Market Data for 2021

The following data is for single-family properties Sold from January 1 to December 31, 2021. Keep in mind that # Active fluctuates daily and this report was put together in January 2022. The CDOM is the Median “Cumulative Days on Market.”

|

Area |

ZIP |

# Active |

# Sold |

CDOM |

Median Price |

Lowest Price |

Highest Price |

Months of Inventory* |

|

Southwest 77494 |

77494 |

80 |

2755 |

6 |

$404,000 |

$150,000 |

$1,700,000 |

0.3 |

|

Northwest 77493 |

77493 |

142 |

1941 |

10 |

$325,000 |

$136,000 |

$1,350,000 |

0.9 |

|

Southeast 77450 |

77450 |

40 |

1208 |

7 |

$340,000 |

$134,000 |

$2,100,000 |

0.4 |

|

Southwest 77441 |

77441 |

133 |

888 |

14 |

$474,000 |

$205,000 |

$2,400,000 |

1.8 |

|

Northeast 77449 |

77449 |

33 |

861 |

6 |

$252,000 |

$120,000 |

$646,000 |

0.5 |

|

Southwest 77423 |

77423 |

66 |

540 |

14 |

$326,000 |

$85,000 |

$760,000 |

1.5 |

|

Northeast 77084 |

77084 |

53 |

513 |

6 |

$240,000 |

$125,000 |

$1,000,000 |

1.2 |

|

Southeast 77094 |

77094 |

6 |

162 |

11 |

$450,000 |

$221,000 |

$1,850,000 |

0.4 |

*Severe Housing Shortage: We should have 3-6 Months of Inventory in most of our Katy neighborhoods. With less than 1 Month of Inventory, we are is a HOT “Sellers Market” and buyers will have to pay top-dollar and request very little extra costs in order to “win” in a multi-offer situations. Make sure you line up a Strong Pre-APPROVAL letter with a good lender as part of your offer package.

Katy Real Estate Market Report 2022

The Katy Real Estate Market changes every month. To see recent data on the 10-year price trends, Days on Market, sales volume, months of inventory, and more, then DOWNLOAD the FREE Katy Real Estate Market Report!

This information is not available on this website.

Last update: January 2022

Download the FREE ReportSales & Price Trends per |

|

|

Includes Real Estate Market Data That You Won’t Find Anywhere Else!

What’s Included

- Ten-year trend of median sales prices by ZIP Code and neighborhood…so you have a baseline in determining a home value.

- Ten-year trend of sales volume by ZIP Code and neighborhood…so you can see which are the most popular neighborhoods.

- Ten-year trend of median Days on Market by ZIP Code and neighborhood…so you can see how long it takes to sell a home in each area.

- List of the most popular neighborhoods in the Katy area…see what neighborhoods are HOT!

- List of the neighborhoods by price (high to low) in the Katy area.

- Detailed market data on the most popular Katy neighborhoods