>>Print this article (PDF file)

Helpful Disaster Supplies You Need

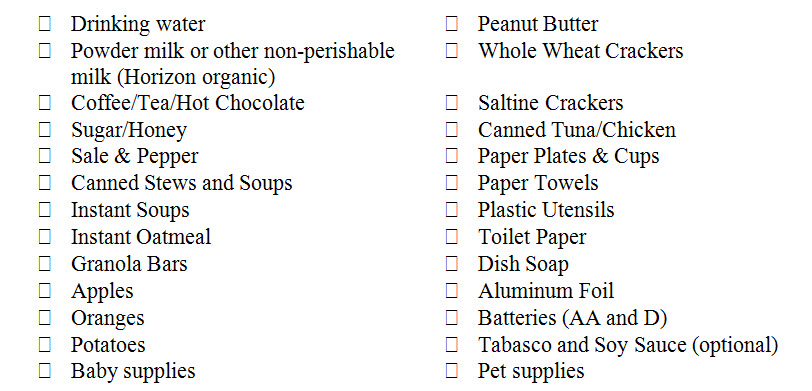

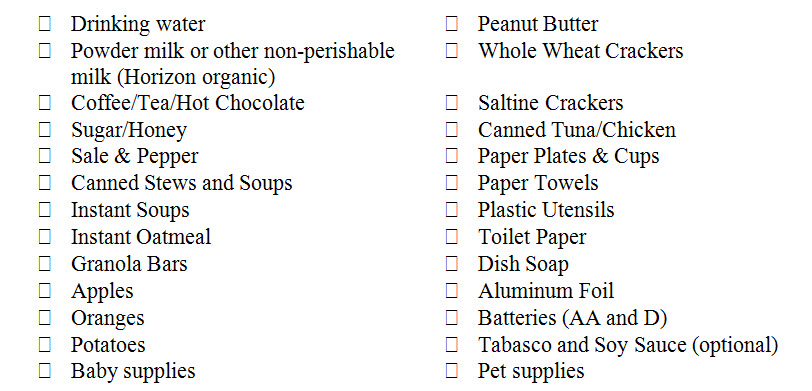

Regardless if it’s a hurricane, tropical storm, or winter storm, here is a great list of helpful disaster preparation supplies (Amazon list) and hurricane supplies (Amazon list2). Most people will not have a budget to buy all of this at once, so try to buy one or two items every month or so, and within a year you will have a lot of supplies. Store all your emergency supplies in one area. Non-food items can be stored in a large plastic container, in case you need to evacuate and take them with you.

>>See also: Katy Preparedness Guide

Create an Emergency Binder and include this Basic Preparedness document. Also print out your email contacts (online address book) and evacuation route map and put in binder. Keep some emergency cash in the binder as well…in case the electric power goes out, ATMs don’t work, and credit cards can’t be used.

What To Do the Week Before a Disaster

For most disasters (hurricanes and winter storms) you will have advance notice. Essential items that you need to survive include: water, food, lighting, cooking gear, and gasoline. Keep in mind that many of these items will not be available AFTER the disaster, so plan ahead.

Before a hurricane, winter storm, or other natural disasters, you should:

1. Store as much water as you can. Water may go offline or have a “boil notice” after a disaster, so store water in jugs, such as a 5-gallon collapsible storage jug, and 2 gallon container with spigot (works great as an alternative faucet for washing hands). Bathtubs can be used as a last resort.

2. Fill up your car with gasoline, whether or not you plan to evacuate. Gasoline is often in shortage after a disaster. If you have a gas generator, get gas for that too. Use Gas Buddy app to find gas after a disaster.

3. Buy non-perishable supplies at a grocery store at least 3-days in advance. Don’t wait until last-minute when shelves will be empty. Perishable items are not recommended since they will spoil if you lose power for an extended period (and refrigerator doesn’t work). Buy enough to last at least 1-week.

Other Helpful Shopping Lists:

4. Make sure you have enough prescription medicines on hand.

5. Charge up all phones and devices. If you have battery backups, or chargeable radio/lanterns, then charge those too.

6. Familiarize yourself with all evacuation routes and shelters.

7. Wash clothes—you may not be able to do so after the storm.

8. Shower and wash hair—you may not be able to do so after the storm.

9. Download the Gas Buddy and Waze apps.

10. Sign up for Nextdoor in your neighborhood and all neighborhood Facebook groups. During Hurricane Harvey, social media had information up to 12 hours ahead of the county’s emergency management system.

11. Freeze plastic bags of water to use for ice after storm.

12. Sign up for emergency alerts at city, county, and MUD websites.

>>See Katy Road Conditions Map or Houston TranStar

How to Prep Home for Hurricanes

The following list will help you prepare for a hurricane:

1. Get flood insurance by May 1…it takes 30 days to go in effect and hurricane season begins in June.

2. Purchase Hurricane Supplies in addition to other emergency supplies. The supplies may be on short supply after the disaster.

3. Know how to turn off the electricity, gas, and water for your home.

4. Print a list of local emergency shelters.

5. Put all outdoor lawn furniture, potted plants, and items that may go airborne in high winds, in the garage.

6. Cover windows with plywood, if possible.

7. Unplug small appliances and propane tanks (gas grills).

8. Make sure all dogs and cats are wearing tags, in case they get lost.

9. Take detailed photos/videos of home and contents (internal and external) for insurance records.

10. You may want sand bags to seal doorways.

11. In an emergency, you can store documents and valuables in a dishwasher (which is waterproof when fully closed).

12. Move valuables upstairs or stack furniture on risers. Get items off the floor if flooding is expected.

13. Prepare a location under the stairs or inside an interior closet as a safety room during high winds, if you can’t evacuate.

14. You may need cleanup supplies: heavy duty garbage bags, ax/chainsaw, broom, mop, bleach (which doesn’t kill mold on porous surfaces, as commonly believed), heavy duty gloves, and more (see list).

How to Prep Home for Hard Freezes and Winter Storms

The following list will help you prepare for a hard freeze or winter storm:

1. Do not leave pets outside during a freeze; 40 degrees or below is dangerous for most mammals.

2. Cover delicate outdoor plants with bed sheets or fabric (better than plastic) and bring potted plants inside.

3. Disconnect water hoses from outside faucets and cover all faucets with insulators (cheap, easy to use, and available at Home Depot).

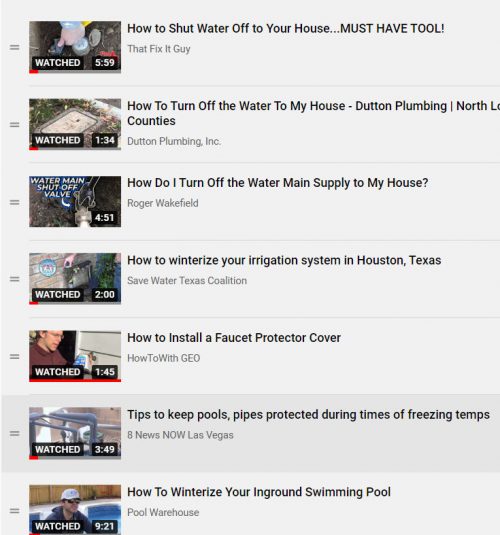

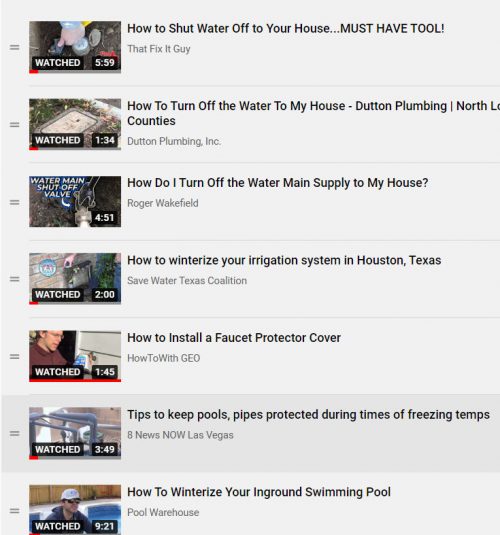

4. Winterize sprinkler system, it’s very easy (see video).

5. Insulate all outside, exposed pipes.

6. Make sure you know how to turn off the “water main” in case a pipe bursts.

7. Drip water (size of angel hair pasta) at faucets at night, especially for kitchen and bathroom sinks that are on an exterior wall. Open the cabinet doors so warm air can get to pipes. If temperatures will be below freezing for more than 6 hrs then shut off water at the main, and open faucets in bathrooms and kitchen to drain lines. Leave faucets open until you open the water main again (when temperature gets above freezing).

8. If you have a swimming pool, make sure you set the pump to run during the freezing temperatures…usually from 10 p.m. to 10 a.m. You want to keep that water flowing! If temperatures will be below freezing for more than 6 hours, then you may want to winterize your pool (videos listed below).

9. If heater goes out due to power loss, “seal” off one room in your house that is near an alternative heat source (fireplace or gas stove in kitchen). Use thumbtacks to hang blankets over doors and hallway entryways to keep cold air out and warm air inside. Keep all family members in one room to retain body heat in one place. Close doors to all other rooms in the house. If you will be using a fireplace*, make sure you have firewood or gel fuel on hand, but always monitor all open flame fires. If using a gas stove in a kitchen, then make sure you have a lighter. Don’t sleep with unattended open-flame fire: fires are silent killers. Keep a fire extinguisher nearby. Make sure you have a carbon monoxide detector in the room. Dress in warm layers and drink warm tea.

*NOTE: Make sure you have your chimney cleaned at least every 3 years…more often if you frequently use your fireplace. Creosote build-up and other issues can cause dangerous house fires (read more). Be safe!

Helpful Videos

Learn how to turn off water main, winterize sprinklers and pool, and more. Check out the videos on my playlist here: https://youtube.com/playlist?list=PL6I6-5nmCmu-JCR0ye7oGEagpILaOMhk8

If You Need Emergency Restoration or Plumbing

|

Howell Services

281-232-5292

http://www.howell-services.com/

Kathy & Lane

281-565-5636

Layne Plumbing

281-980-6265

|

Francis Emergency Plumbing

346-567-8668

Katy Plumber

281-391-2001

Emergency Home Plumbing

346-708-6298

Servpro

281-342-5326

Roto-Rooter

713-470-0080

|

More checklists: Primal Survivor Website

Print this article (PDF file)

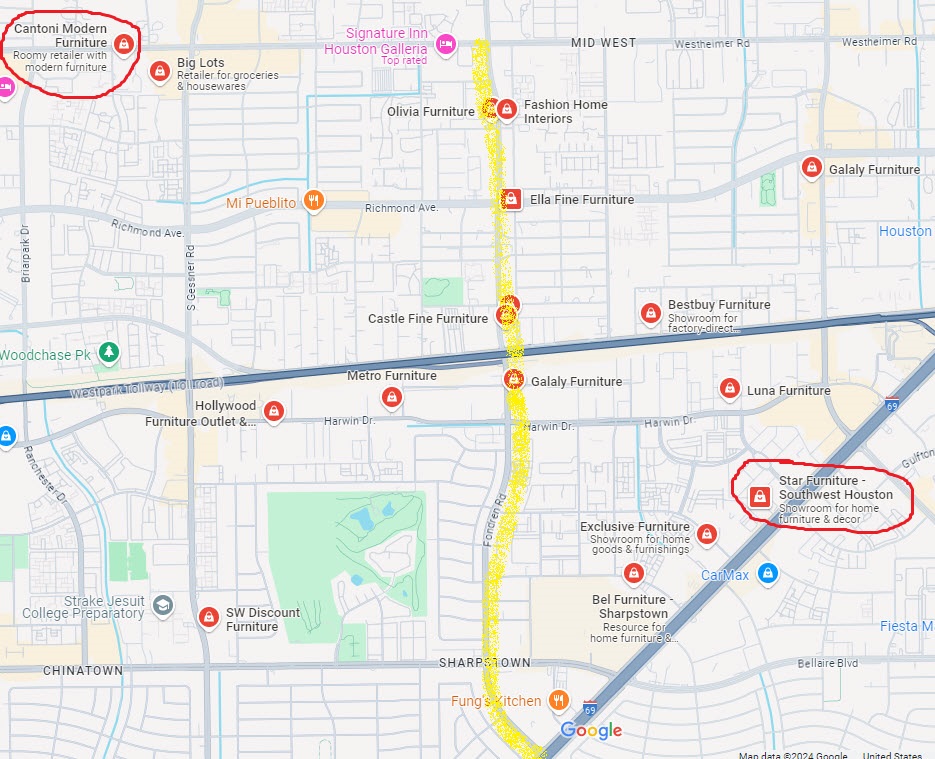

If you head north on Fondren from I-59, you will find a lot of different furniture stores. I call this section, up to Westheimer, “Furniture Row.” You will also find rug, fabric, and lighting stores in that area.

If you head north on Fondren from I-59, you will find a lot of different furniture stores. I call this section, up to Westheimer, “Furniture Row.” You will also find rug, fabric, and lighting stores in that area.

Get the Report!

Get the Report!

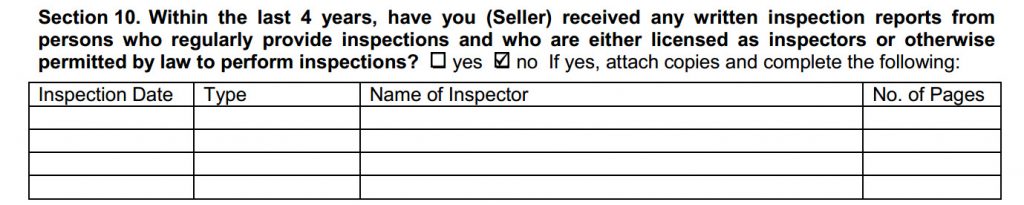

A ground-fault circuit interrupter (GFCI) is the only protection device designed to protect people against electric shock from an electrical system. Most of the time, these outlets are obvious with Test and Reset buttons. However, you can connect a regular outlet to an outlet with a GFCI so that it is protected, but it will not be obvious to the inspector. So if you know you have some outlets like this, especially in the kitchen or bathrooms, then clearly label those outlets and specify the GFCI outlet they are tied to. This is something that inspectors can’t just “know” by looking at it, so they will mistakenly report this on an inspection report.

A ground-fault circuit interrupter (GFCI) is the only protection device designed to protect people against electric shock from an electrical system. Most of the time, these outlets are obvious with Test and Reset buttons. However, you can connect a regular outlet to an outlet with a GFCI so that it is protected, but it will not be obvious to the inspector. So if you know you have some outlets like this, especially in the kitchen or bathrooms, then clearly label those outlets and specify the GFCI outlet they are tied to. This is something that inspectors can’t just “know” by looking at it, so they will mistakenly report this on an inspection report.

When you purchase a resale home, you can purchase a home warranty (a.k.a., Residential Service Contract or RSV) that will protect you against most ordinary flaws and breakdowns for at least the first year of occupancy. The warranty may be offered by either the Seller, as part of the overall package, or by the agent. Even with a warranty, you should have the home carefully inspected before you purchase it.

When you purchase a resale home, you can purchase a home warranty (a.k.a., Residential Service Contract or RSV) that will protect you against most ordinary flaws and breakdowns for at least the first year of occupancy. The warranty may be offered by either the Seller, as part of the overall package, or by the agent. Even with a warranty, you should have the home carefully inspected before you purchase it.